How to Use a Secured Credit Card Properly

How to Use a Secured Credit Card Properly

How to Use Secured Credit Cards to Build Credit

Secured credit cards can help you improve and rebuild your credit. Read on for tips on how to use secured credit cards to build credit!

By Ben Luthi

Reviewed by Lauren Bringle, AFC®

If you're trying to build credit, a secured credit card is one of the best tools to help you achieve your goal. That may be why a lot of people consider them "credit-building credit cards."

So, how does a secured credit card work? In this guide, you'll learn how you can use secured credit cards to help you improve your credit history and what you need to do to pick the right one.

Ready to find the best credit cards to build credit? Read on to find out how.

In this article

- What is a secured credit card?

- Build credit with a secured credit card

- How to choose the best secured credit card

- Applying for a secured credit card

- Benefits of a secured credit card

What is a secured credit card?

There's just one big difference between a secured credit card and a traditional unsecured credit card. A secured card requires a security deposit to use as collateral for the credit limit.

The minimum security deposit can be as low as $200 or $300 and is usually equal to your desired credit limit. In addition, the security deposit is refundable, and the credit card issuer holds onto the security deposit in case you don't make your payments.

That security deposit enables credit card companies to offer credit to people who have a below-average credit score or even bad credit.

Learn more about how security deposits work for secured credit cards.

With responsible use, a credit card can help you improve your credit score.

"You get your deposit back when you either close the card after having paid your balance in full or when you show responsible credit card use and graduate to an unsecured card with the same bank," according to Brooklyn Lowery, managing editor for CardRatings.com.

You may even be able to request a credit limit increase without putting more money down.

When you close your secured card account, you can apply for an unsecured card that doesn't require an upfront security deposit. But be aware that closing a credit account gets rid of the available credit associated with it. As a result, closed credit cards won't continue to help you with your payment history or average age of accounts.

Secured credit cards are not the same as prepaid cards. A prepaid card is a reloadable debit card, not a credit card.

"While prepaid debit cards can be a way to control and manage your spending, you aren't technically borrowing any money," says Lowery. "So there's no opportunity for you to show that you can make good on your debts."

Will a secured credit card build credit?

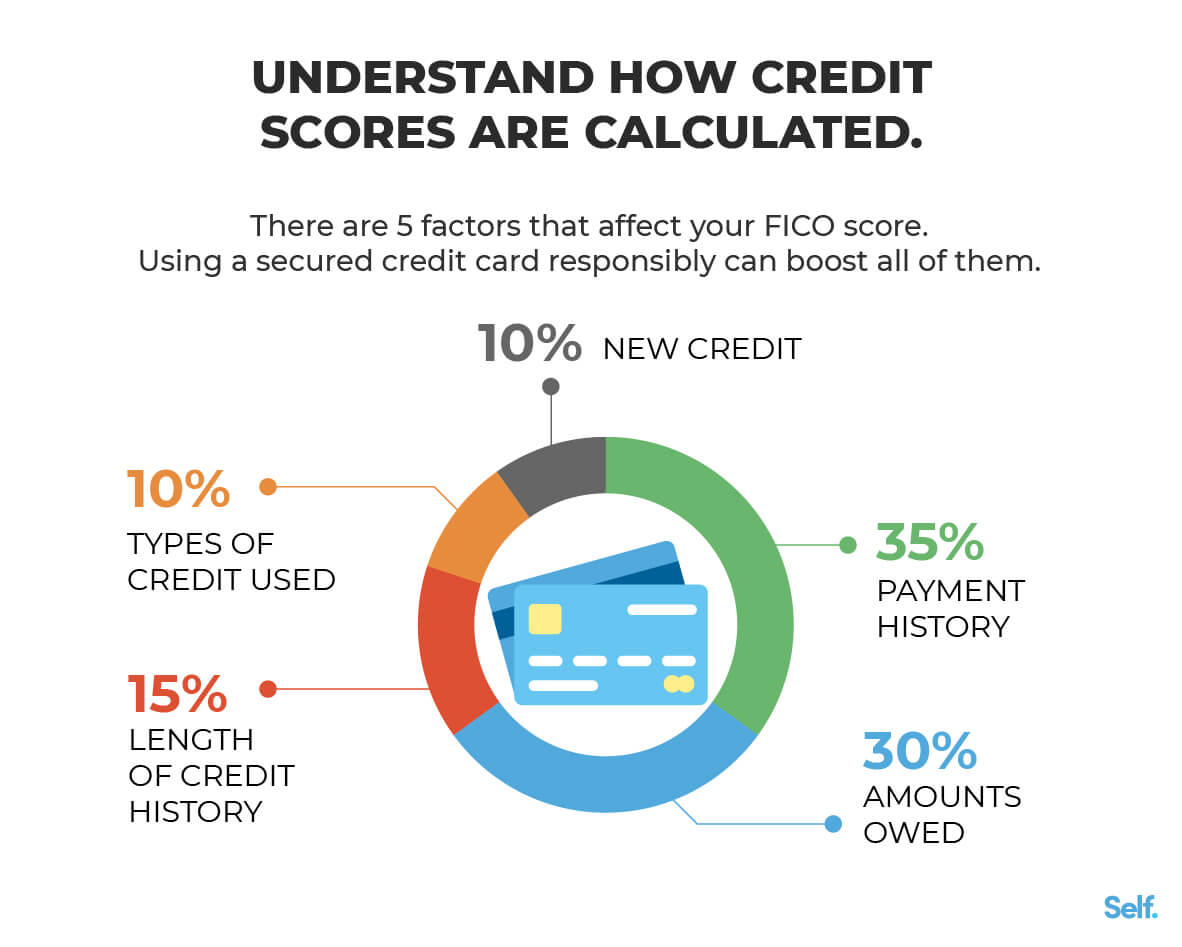

The two most important factors in your FICO credit score are your payment history and your credit utilization. Credit utilization is your card balance divided by its credit limit.

In total, they make up 65% of your score.

You establish credit history through building payment history. You build payment history by regularly using a secured credit card and making your payments on time every month. In fact, if you pay off your balance in full each month, you can build credit without paying any interest on the account.

In addition to making timely payments, when you keep your card balance low, it shows creditors that you don't need to rely on credit just to get by.

A widely accepted rule is to use less than 30% of your credit line each month.

While you use your secured credit card over time, it will also boost your length of credit history, which makes up 15% of your FICO credit score. See our related article about how long it takes to build credit.

You don't necessarily need to open other card accounts or take out a loan to boost your credit-building efforts. Instead, just by using a secured credit card, you can learn how to build credit fast.

That said, having a healthy mix of credit accounts for 10% of your credit score.

A healthy credit mix means having both revolving credit (like your secured credit card) and an installment loan (like a credit builder loan, mortgage, or car loan).

So, using a credit builder loan in conjunction with a secured card could help you build credit more quickly since you will have two types of credit on your credit report.

How to choose the best secured credit card

There are several secured credit cards to rebuild credit, but not all of them are worth considering.

Instead of taking the first offer that comes your way, take some time to research secured cards and what they have to offer.

Here are a few things to look out for when shopping for secured cards.

1 - Look at the fees

Some secured credit cards charge an annual fee and other fees. Others, however, don't have a yearly fee but may charge you for a cash advance or balance transfer.

2 - Make sure they'll help

Some secured cards don't report your account activity to all three major credit bureaus. Unfortunately, this means that even if you use the card responsibly, it may not help you build your credit history with a credit bureau.

Unlike a debit card, savings account, or checking account, opening a credit card and using it responsibly can help you build good credit. For example, suppose you open a credit card that is reported to all three major credit bureaus. In that case, you can build up your credit in a way recognized by future lenders, no matter what bureau they pull your credit report from.

3 - Consider the source

Some well-known credit card issuers like Capital One and Discover offer secured credit cards. Still, you may not know most of the banks that issue most secured cards.

Do your research to make sure the issuer is reputable and offers a good customer experience.

4 - Look for standout features

Some secured credit cards offer basic features, while others add extra appeal.

With the Self credit builder card, for instance, there's no hard credit check involved. Also, instead of putting down a security deposit, you'll use savings you've built up with your Credit Builder Account, so there's no extra deposit needed.

Some other secured cards offer the opportunity to earn rewards or a reduced security deposit.

5 - Check with a credit union

Credit unions typically offer a lower interest rate and other fees compared to traditional banks.

What to consider before applying for a secured credit card

While secured credit cards can help you improve your credit score, they're not for everyone. In fact, while you can get a secured credit card with no credit or bad credit, there's no guarantee that the card will help you improve your credit.

Secured cards typically require a credit check, and if you've made some significant credit missteps in the past, you may get denied. As a future cardholder, the best thing you can do is to fix your poor credit or work on improving your score so you can avoid being denied by your bank.

"You'll generally need to be able to show a source of income and meet all age and other requirements and then, of course, come up with the funds for the security deposit," Lowery says.

Denied for a secured credit card?

If you have been denied a secured credit card, pause before applying for other cards. Each credit card application will make a hard inquiry on your credit report. Hard inquiries will temporarily hurt your credit score.

Instead, consider an alternative or ask a family member or friend who has good credit if you can get added as an authorized user on their card account.

As an authorized user, you can enjoy the good credit history of their credit card account without the legal obligation to pay the balance to the card issuer. Over time, your credit score can improve, and you'll have a better chance of getting approved for a card of your own from your desired credit card company.

Beware of the risks of credit cards

Even if you get a secured credit card, there are some risks to keep in mind. The biggest risk is that you may be tempted to spend more on your card than you can repay from your bank account.

And if you don't pay your balance in full each month, you could be stuck paying an interest rate as high as 25% or more.

So, suppose you've had problems with overspending in the past, or you just want to avoid the temptation to spend. In that case, you may be better off with a credit builder loan or some other type of credit-building product.

As a result, it's wise to take the time to consider all of your options before making a decision. One option is to compare several secured cards to find the right one for you. Another option is looking at alternative ways to build credit that don't require you to get your own secured card.

Benefits of getting a secured credit card

Don't know whether you should go for a secured credit card or a traditional credit card? Before you go the traditional route, make sure you review the many benefits of a secured card to make an informed decision.

You can apply for a secured card with no credit

One of the most significant benefits is that people with poor credit or no credit history can still apply for a secured credit card.

With an unsecured card, most banks will not risk giving someone credit unless they prove they have a strong credit history. With a secured credit card, all you have to do is pay a cash deposit that will serve as a safety net if you are ever late on your payments.

Keep in mind that some card companies will deny you a secured card if you have a history of bankruptcy or foreclosure.

You have a chance to re-establish credit

Another benefit is that you can re-establish good credit if you're using a secured card.

Unlike a prepaid card, your payments should be included in your credit report. They can improve your score as long as you make your monthly payment on time and keep your credit card balance low.

Once you have shown that you can make on-time payments and build up your score, you will have more financial freedom to qualify for other credit cards in the future.

Something to keep in mind

If you are late on your payment, your card issuer will likely enforce a late payment penalty. Although there are federal limits to how much can be charged for a late fee, it's not worth being late. Always make your payments on time. Paying on time will save you late fees and accrued interest.

The bottom line

There are several different secured cards on the market, and there's no single card that's better than the rest for everyone.

Most secured credit card issuers run a credit check, which means you could be denied based on your credit score or something on your credit report. However, some credit cards don't run a credit check at all.

Most secured credit cards don't offer a cash rewards program. That may not bother you if your top priority is building credit, but consider cards that provide that type of reward if you want to get cash back.

In most cases, you'll be required to make a security deposit equal to your desired credit limit. Also, find out when you can get your deposit back because some cards may return it before you close your credit card account with your company. That may be preferable if you want to keep your card open longer.

As you compare these features to a regular credit card, you'll have an easier time finding the right card so you can start working on your credit.

We went ahead and summarized everything you need to know about using secured credit cards to build credit in the following infographic. To share it on your own site, just copy and paste the embed code below.

Work towards your own secured card. Get the Self app to start building.

Sources:

- Credit Karma. "How a secured card deposit relates to your credit line". https://www.creditkarma.com/credit-cards/i/secured-card-deposit-credit-line

- Insider. "The best starter credit cards of September 2021". https://www.businessinsider.com/personal-finance/best-starter-credit-cards

- Forbes. "What Is A Secured Credit Card And How Does It Work?". https://www.forbes.com/advisor/credit-cards/what-is-a-secured-credit-card/

Ben Luthi is a personal finance writer who holds a bachelor's degree in finance from Brigham Young University. See Ben on Linkedin and Twitter.

About the reviewer

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s). Self is not providing financial advice. Please consult with a professional about your personal financial situation.

Source: https://www.self.inc/blog/secured-cards-build-credit

Posted by: curnowphim1978.blogspot.com

0 Response to "How to Use a Secured Credit Card Properly"

Post a Comment